Max 401k contribution 2021 calculator

Pilots receive pro rata share of the 10 of adjusted pretax income before profit sharing and special items up to a pre-tax margin of 18. If your employer offers 401k account and some contribution match make sure you contribute to your 401K account to maximize your employers match first.

How Much Can I Contribute To My Self Employed 401k Plan

For 2021 the max contribution is 58000 and 64500 if you are 50 years old or older.

. You could consider a 401k for 2021. 135 of the pilots salary. Plus if youre over age 50 you get a larger catch-up contribution maximum with the 401k 6500 compared to 1000 in the IRA.

So if you put in todays date 12302021 you might get them purchased tomorrow in 2021. Keep this deadline in mind if you need a last-minute tax deduction and have the extra cash. 2021 HSA Contribution Limits.

For 2021 and 2022 6000 per year 7000 per year for those age 50 or older. Individuals over the age of 50 can contribute an additional 6500 in catch-up contributions. We may have changed your purchase dates to the next available business day.

The pension plan is also separate. The 401k plan annual contribution limit is 20500 while the catch up contribution is 6500. Rebalance your investments in your 401k as needed to stay aligned with your financial goals risk tolerance and the.

This means that if you are 50 or over you can contribute a total of 27000 per year into your 401k. If you want to get a larger contribution for 2020 you can only do a cash balance plan or defined benefit plan. If you select today it may work.

For 2022 20500 per year 27000 per year for those 50 or older. Pilots hired before 2010 and who elected soft freeze of A plan receive 135 401k contribution. Just a little bit short of your retirement savings goal.

In 2021 you can put up to 6000 into a Roth IRA and an extra 1000 catch-up contribution if youre age 50 or older. Given the 401k maximum contribution limits have increased over time the three columns from left to right can also be used as guidance for older savers over 45 years old middle aged savers between 30 45 and younger savers under 30 who get to max out at 20500 a year 2022 max at the minimum for the majority of their careers. You can correct the contribution and deposit the correct amount and take the tax deduction.

According to a Vanguard study only 12 of plan participants managed to max out their 401k in 2019. The elective deferral limit for SIMPLE plans is 100 of compensation or. For 2022 the 401k contribution limit is 20500 in salary deferrals.

2022 HSA Contribution Limits. How to Max Out a 401k. Contributions to a traditional 401k are always tax-deductible.

The 5 year clock starts in the year for which the Roth solo 401k contribution was made eg. 3600 4600 if age 55 or older Families. A contribution is the amount an employer and employees including self-employed individuals pay into a retirement plan.

7200 8200 if age 55 or older The contribution deadline is April 15 2022 the federal income tax deadline. New-hires receive 135 company contribution to their 401k. Many employers offer a match based on a percentage of your gross income.

You can only contribute a certain amount to your 401k each year. To contribute to a Roth IRA in 2022 single tax filers must have a modified adjusted gross income MAGI of 144000 or less up from. Below is the key rules of thumb.

Best Tax Software For The Self-Employed 2021-2022 Tax Brackets. Your total contribution including employer-matching funds cannot exceed 61000or 67500 for workers 50-plus. If you started investing 250 per month at the age of 25 and earned an average annual return of 6 for example youd have 567539 by the time you reached the age of 67.

CD Calculator. 8 Sticking with our example above maxing out your Roth IRA and investing 6000 into your account brings your total retirement savings for the year to 9750. For instance in 2022 the 401k contribution limits rose 1000 from 2021 You start full-time employment at age 22 at a company that provides a 401k without a company match.

The contribution limit is 56000 in 2019 and 57000 in 2020. The numbers are more forward-looking vs. 155 effective 1 Jan 2019.

Yes since you made the Roth solo 401k contribution for 2020 in 2021 by your business tax return plus timely filed business tax return extension. Get your 401k match then max out your IRA. No pilot contribution required.

Your 457 contribution is separate. They cant come from your W2 job pensions rental income or other sources not considered to be self employment income. You can open a solo 401k for your 1099 income in 2020.

There are two sides to your contribution. The contributions at County hospital A do not affect your solo 401k contributions. Backward since the average 401k contribution limits were lower in the past.

A Roth IRA conversion is a way to move money from a traditional SEP or SIMPLE IRA or a defined-contribution plan like a 401k into a Roth IRA. This could allow you to max out your annual contribution limit while purchasing new investments at a discount when the market is down. What you provide as the employee and the match from your employer if applicable.

Apr 28 2022. Use the solo 401k calculator to find out how much you can contribute. You can see more details in our in-depth analysis and comparison between IUL and 401K to see which is better for your personal retirement savings plan.

For the tax year 2022 which youll file a return for in 2023 that limit stands at 20500 which is up 1000 from the 2021 level. I went through BuyDirect and chose 12302021 it on the final page before I would click submit said. 2020 Roth solo 401k contributions made in 2021 start clock on 112020.

Dayana Yochim Andrea Coombes. Additional contribution limits may apply to Highly Compensated Employees. If your goal is to max out your contribution for the year you might set a recurring deposit of 500 per month.

The combined contribution limit for all of your traditional and Roth IRAs is 6000 in 2022 7000 if. Hi Ali you have to contribute the same percentage of W2 to the eligible employees including yourself. For Solo 401k the contributions have to come from your sponsoring business.

Yet most people dont know how to max out a 401k. Effective 1 Nov 2017 all pilots hired after 2010 receive 15 401k company contribution. 19500 in 2020 and 2021 19000 in 2019 18500 in 2018 and 18000 in 2015 - 2017 or 100 of the employees compensation whichever is less.

New 401 K Rules For 2021 Due

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

How Much Should I Have Saved In My 401k By Age

401k Contribution Limits And Rules 401k Investing Money How To Plan

The Maximum 401k Contribution Limit Financial Samurai

Solo 401k Contribution Limits And Types

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Investing Investing Money Roth Ira

Solo 401k Contribution Calculator Solo 401k

401k Calculator

Solo 401k Contribution Limits And Types

Employer 401 K Maximum Contribution Limit 2021 38 500

Free 401k Calculator For Excel Calculate Your 401k Savings

The Maximum 401k Contribution Limit Financial Samurai

How Much Should People Have Saved In Their 401ks At Different Ages See More At Http Www Financialsamura Saving For Retirement 401k Chart Finance Education

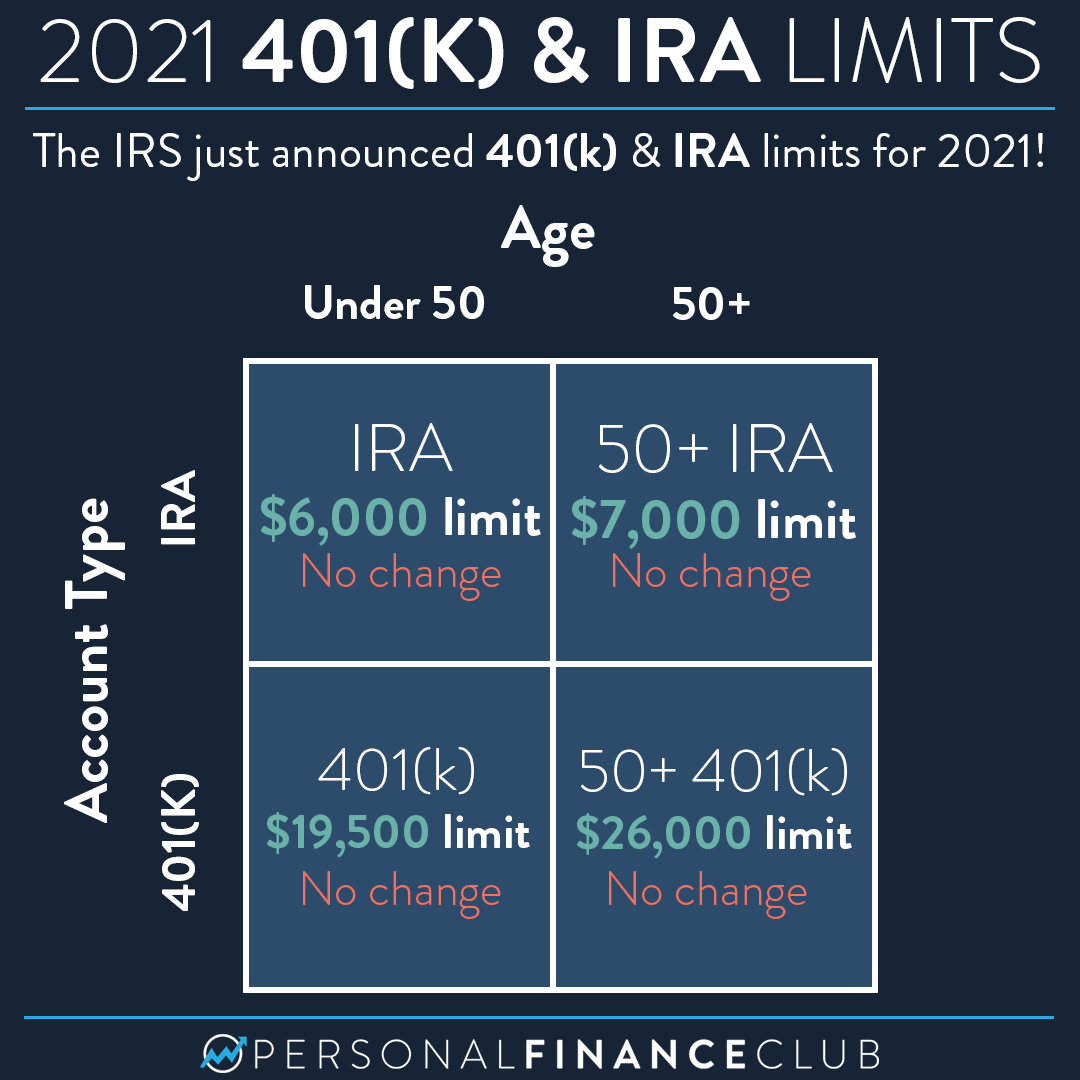

2021 Contribution Limits For 401 K And Ira Personal Finance Club

Solo 401k Contribution Limits And Types